BPM completes oversubscribed placement to advance gold exploration

Earlier this week BPM Minerals (ASX: BPM) completed a $1.675M capital raise.

The raise was done at $0.10 (discount of 4.8%), there were no options and it was heavily oversubscribed.

For the current market - that is as strong a placement as we have seen.

We participated in the placement, increasing our Investment in BPM.

The strength of the raise probably has something to do with the recent discovery that BPM announced at its Claw gold project in WA.

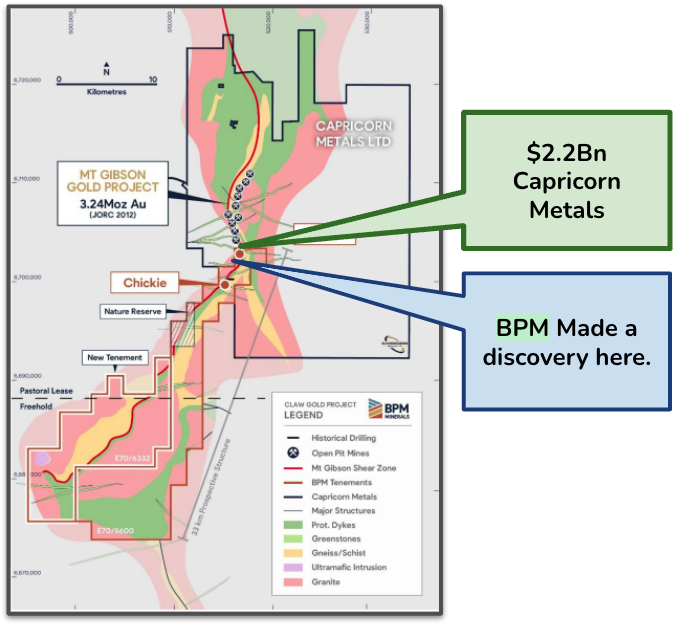

Claw is BPM’s gold project next door to $2.2BN Capricorn Metals’ Mount Gibson project where the company already has a Xm ounce gold resource.

BPM made its discovery just a few weeks back and has seen its share price almost triple off the back of that news.

We like this raise by BPM because it gives BPM cash to go and drill out its discovery to see if it has genuine size/scale potential.

The discovery hole was a 30m intercept at 1.8g/t of gold - considering the grades at Capricorn’s Mount Gibson average ~0.8g/t. We think the hit from BPM is pretty strong.

Raising money off the back of this discovery and while gold is at a historic US$2,675 per ounce this week is exactly what we want to see from our early stage exploration companies.

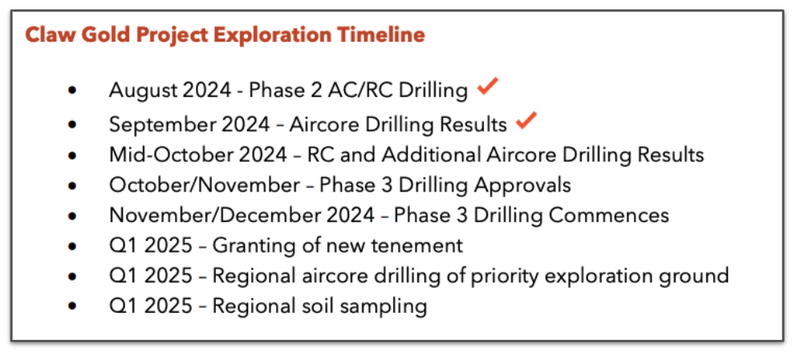

BPM says that the planning of a Phase 3 drill program has already commenced, and now we await the program of work by the company.

More assays are also set to come from the Phase 2 drill program.

Here is a look at BPM’s timeline:

If you want to read more about BPM’s Claw project we covered it recently in a note here: BPM Announces New High Grade Gold Discovery at Claw Project.